What is going on with banking? – March 2023

What is going on with banking?

Prepared by: Centrepoint Alliance

March 2023

1. What occurred with Silicon Valley Bank?

The initial signs of weakness within the banking sector started with the amazing collapse of Silicon Valley Bank (SVB). SVB was the US’s 16th largest bank with about $209 billion USD in assets. The main depositors of SVB were primarily venture capital technology companies who saw tremendous growth in business activity during the Covid-19 pandemic period. SVB took this influx of savings and bought long-dated US government bonds with that money during this period where interest rates where ultimately near 0%. This means bonds were very highly valued (remember, when interest rates increase bonds lose value and vice versa). What SVB did not predict (much like the rest of the world), was a 40-year high in inflation and consequently some of the sharpest interest rate increases seen since the 1980’s. This meant that all of those bonds that were bought by the bank started to lose value, and quickly. The bank did not hedge out their interest rate risk at all in severe lack of prudential responsibility.

Twitter started to get wind of the fact that the money deposited in this bank was invested in long-dated US government bonds and that the value of these bonds had decreased tremendously. Then began the first Twitter-fuelled bank run. Approximately $42 billion dollars was withdrawn from the bank in one day. SVB had to sell these bonds at a loss to allow people to take their money out and resulted in the bank not having enough capital to reach these requirements and caused insolvency.

2. Other banks since being impacted

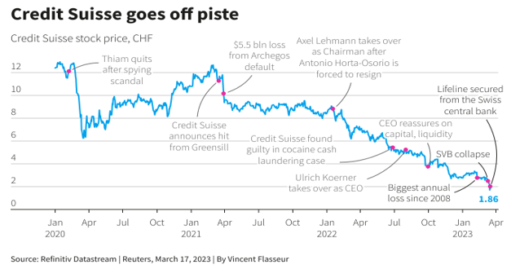

Credit Suisse is the most significant victim of the latest turmoil in the banking sector. They have been at the centre of multiple scandals, management turnover and investment losses over the past few years which had significantly decreased confidence in the bank. Customers have consequently been withdrawing their money over these years and at an increasing rate. This is combined with an inability of its top investors to keep pouring money into the bank.

All of this finally amounted to UBS purchasing the bank under government-led direction for about $3 billion USD. The Swiss central bank has allowed Credit Suisse to draw on money (which it quickly did) to ensure it had the capital for depositors to withdraw if need be and for normal banking operations to continue.

3. What Now? Is this another GFC (Global Financial Crisis)?

It is difficult to say how significant these events are and what sort of contagion is to be expected. The chances of this being another GFC, however, are unlikely due to a couple key differences. During the GFC, the centre of the banking crisis was predicated on low-quality loans bundled up in mortgage-backed securities and bought by banks all around the world. This is not the case this time around as banking standards of lending have improved tremendously. Secondly, in direct response to these recent events, central banks around the world have made it extremely clear that they will inject enough money nearly instantaneously to ensure that banks have enough money to draw on. This lack of hesitation is a clear difference to the central bank ‘playbook’ that was in place before the GFC. Back then, central banks were more uncertain of which actions to take to quell such disarray. Now, within 1-2 days, deposits are guaranteed by governments and/or the bank in question is flooded with money to ensure they have enough.

This sort of immediate reaction can be likened to the action taken during the Covid-19 crisis where central banks and governments employed the same tactics. What was the result? An immediate end to the market panic and markets restoring confidence quickly.

4. So what?

Both central banks and governments will not hesitate to continue to use these measures. Even though the moral hazard consequences of guaranteeing deposits may be very questionable, they have learnt that confidence in the banking sector is key. This does not guarantee this won’t be a bumpy ride, but it does mean that overreactions by investors and sell-downs of portfolios as a result of these news headlines could be followed with regret. The mantra of “don’t fight the Fed (Federal Reserve Bank of the US)” is one that markets will continue to live by. Whether you agree that central banks and governments should be able to have this ability is besides the point. One thing is for sure and that is; governments and central banks will do whatever it takes to resolve a banking crisis.

This is how the system currently works and premature panic has not resulted in positive portfolio outcomes in previous crises such as the GFC and Covid-19. Remaining invested is paramount and lowering risk within the portfolio is the first measure that should be taken if there are concerns.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.