Market Review – September 2023

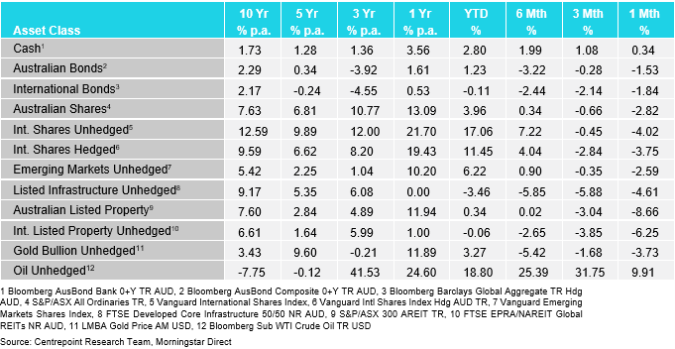

How the different asset classes have fared:

(As at 30 September 2023)

International Equities

International Equities performed poorly in September as both unhedged and hedged shares fell by 4.02% and 3.75% respectively. This result is not unexpected as there was downward pressure on equities from multiple angles, including rising oil prices and bond yields.

The only sector to end in the green this past month was energy at 0.65%, spurred on by the OPEC production cuts and the resulting increases in oil prices. The next best were communication services and health care which still fell by 2.63% and 3.55% respectively.

The worst performing sector was the technology sector which fell by 7.05%. The announcement by the Fed that they expect to maintain interest rates at a high level well into 2024 triggered a rise in bond yields and dampened interest in growth stocks that the tech sector largely consists of. Close behind tech was real estate which fell by 6.8% which was also partly due to the expectation of rates remaining higher for longer.

Australian Equities

Australian shares also performed poorly in September as they fell by 2.82% with every sector retreating over the month. This most likely stemming from the release of the RBA minutes stating that further tightening in policy may be required should inflation prove more persistent than expected.

The best performing sector was once again energy, the cushioning provided by rising oil prices led to a slight retraction of 0.3%. This was followed by financials at -1.5%, materials at -1.9%, and industrials at -2%. The three worst performing sectors were health care at -4.7%, technology at -6%, and real estate at -7.2%. Tech and real estate falling due to similar reasons as their international counterparts.

With both international and domestic equities falling significantly this month continues the historical trend of September being a weak month for stock markets.

Domestic and International Fixed Income

In September, Australian bond prices fell by 1.53%. This retraction was due to continued high inflation and a tight labour market that led the RBA to consider either increasing or maintaining a high cash rate until this sticky inflation comes under control. This led to an increase in bond yields and a reduction in bond prices as investors expect high rates further into next year.

International bond prices fell by 1.84% as a similar situation played out globally and more specifically in the US. With expanding economic activity, strong job gains, low unemployment, and elevated inflation the Fed maintained rates at 5.25-5.5% while also keeping the door open for potential rate increases in the future. This had the same effect as in Australia with bond yields increasing and their prices decreasing as a result.

Australian Dollar

The Australian Dollar (AUD) rose by just 0.34% over the month. The AUD depreciated against the Euro and United States Dollar while appreciating against the Great British Pound and Japanese Yen. The growth was hampered by weak Chinese data, a deterioration in global market sentiment, and a rise in Fed funds rate expectations.

Commodities – Gold and Oil

Gold fell by 3.73% in September, steepening its decline from the previous month. In August there were mixed expectations for future interest rates but this month the Federal Reserve announced that it is not ruling out further interest rate increases. This increased the attractiveness of bonds and lowered the attractiveness of gold, lowering its price.

The only asset class to grow in September besides cash, oil continued its rise this month with an increase of 9.91%. With the OPEC production cuts not scheduled to end before 2024 we can expect these oil price increases to continue for the rest of the year.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.