Market Review – November 2023

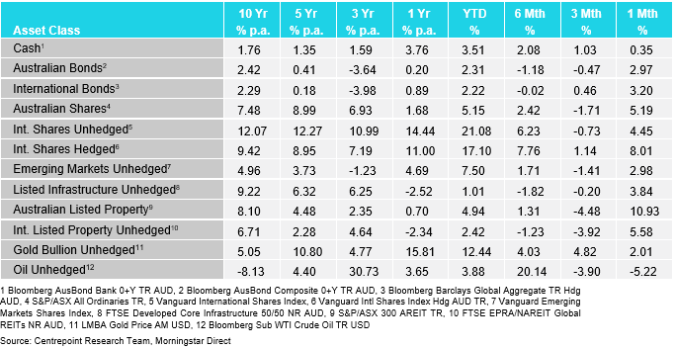

How the different asset classes have fared:

(As at 30 November 2023)

International Equities

November brought encouraging news in the international equity markets, marking a significant upturn for the first time in several months. Unhedged shares showed a healthy increase of 4.45%, but it was hedged shares that truly stood out, registering an impressive 8.01% growth. This notable performance in hedged shares is largely due to the deceleration of inflation in the United States, prompting a revaluation of the timeline for interest rate cuts by the Federal Reserve. As a result, the US Dollar has become somewhat less appealing when compared to the Australian Dollar.

Most sectors witnessed positive growth during this period. Energy was the sole sector to experience a decline, albeit a modest one at 1.32%. This trend in the Energy sector appears to be a reaction to the subsiding impact of the Israel-Palestine conflict and the market’s adjustment to the supply reductions implemented by OPEC. Although Utilities and Consumer Staples were the lower-performing sectors, they still managed to record growths of 3.39% and 3.81% respectively.

The most impressive performances were seen in the Real Estate, Technology, and Finance sectors, with remarkable growth rates of 11.7%, 10.43%, and 9.99%. Overall, international equities had a notably strong performance in November, buoyed by increased investor confidence following indications that the interest rate hikes in the US are effectively moderating inflation.

Australian Equities

Australian equities also showcased strong performance in November, with the overall market expanding by 5.19%. Among the various sectors, only Energy, Utilities, and Consumer Staples concluded the month with a downturn. Energy and Utilities experienced more pronounced declines, dropping by 7.3% and 6.1% respectively, whereas Consumer Staples saw a marginal retraction of just 0.8%.

In contrast, all other sectors finished positively, with Healthcare (11.9%), Real Estate (10.9%), and Technology (8.2%) leading the forefront. The Healthcare sector’s success was driven by robust performances in specific stocks. Meanwhile, both Real Estate and Technology sectors benefited from the optimism that the slowdown in inflation observed internationally would soon reflect in the Australian market.

Overall, November was marked as a buoyant month for the Australian equity market. This upbeat mood was largely influenced by the enthusiasm over the deceleration of inflation in global markets, which had a positive spillover effect, despite Australia’s domestic inflation remaining somewhat higher than that observed overseas.

Domestic and International Fixed Income

In November, Australian bond prices experienced an uptick, rising by 2.97%. This increase came despite an early-month hike in the cash rate by the Reserve Bank of Australia (RBA). Interestingly, bond yields declined in the face of the cash rate increase, a trend attributed to the ongoing slowdown in inflation. This deceleration in inflation has led investors to speculate that we may be nearing the peak of interest rates.

Similarly, international bond prices showed positive movement, with a 3.20% increase in November. This gain is largely due to weakening inflation figures from abroad, especially in the United States, which have uplifted investor sentiment. The prevailing belief among investors is that many countries have reached their peak interest rates, with expectations of a series of rate cuts throughout 2024 as inflation continues its trajectory towards target levels.

Australian Dollar

Over the course of November, the Australian Dollar (AUD) witnessed a modest appreciation, increasing by 0.35%. During this period, the AUD strengthened against major currencies such as the United States Dollar, the Euro, and the Japanese Yen. However, it experienced a slight depreciation against the Great British Pound. This overall upward trend in the value of the AUD can be linked to the prevailing market perception that interest rates are likely to decrease sooner in overseas economies than in Australia. This anticipation has made the AUD a more attractive option for investors, compared to other currencies.

Commodities – Gold and Oil

In November, gold prices experienced a 2.01% increase, indicating a continued growth trend, albeit at a slower pace compared to October. This rise in gold value was influenced by two key factors: a depreciation in the US dollar and a decline in the yield of the 10-year US Treasury bond, which fell from a 16-year high of five percent to four percent.

In contrast, oil prices saw a decline of 5.22% over the same period, marking it as the only asset class in our update to conclude the month on a negative note. This decrease in oil prices can be attributed to a combination of weakening demand and uncertainties surrounding production. Despite OPEC’s announcement of potential additional supply cuts, the impact on oil prices was minimal, primarily due to scepticism regarding the producers’ commitment to reducing output as pledged.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.