Market Review – June 2021

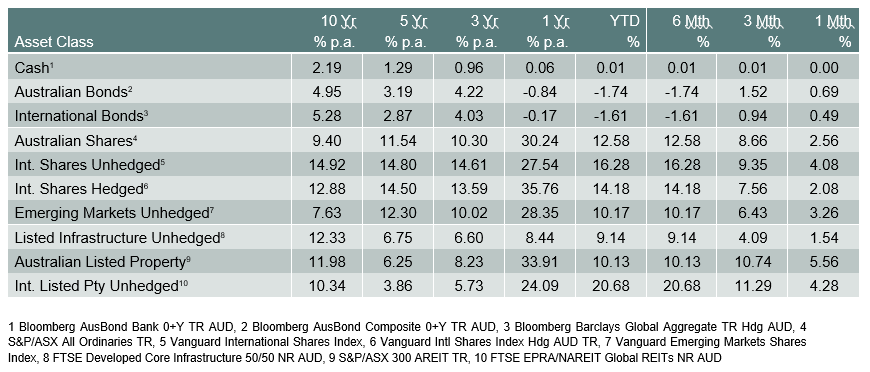

How the different asset classes have fared:

(As at 30 June 2021)

International Equities

International share markets (hedged) rose by 2.1% in June. Movements in share markets over the month were largely driven by comments from members of the US Federal Reserve (Fed) about the timing of future interest rate hikes. Share markets initially fell after the Fed brought forward the timeline of expected interest rate hikes at its June meeting due to the stronger-than-expected economic recovery (the median expectation of Fed officials showed two rate hikes in 2023 from zero after their March meeting). However, share markets rebounded after Fed Chair Powell calmed markets by reiterating that the recent spike in inflation is likely to be temporary, and it will prioritise a “broad and inclusive” recovery of the jobs market before raising interest rates.

Overall, share markets continued to be underpinned by a strong recovery in the global economy, the ongoing rollout of vaccines and the prospect of further significant fiscal stimulus in the US.

Global inflation readings continued to increase in June. However, economists largely expect the current spike in inflation to be transitory. The key drivers of the recent increase in global inflation are base effects (as last year’s deflation drops out of annual calculations), higher commodity prices, supply chain bottlenecks (due to production curbs during the pandemic) and consumers switching spending from services to goods.

Australian Equities

The S&P/ASX All Ordinaries Index rose by 2.6% in June, supported by continued strength in the domestic economy. The release of GDP data for the March quarter showed that the economic recovery in Australia has been V-shaped, with the level of output in Australia now above its pre-pandemic level; not many other countries are in this same position. The employment data for May showed a strong increase in employment and a fall in the unemployment rate from 5.5% to 5.1%. The level of employment in Australia is now also above its pre-pandemic level. Australia and New Zealand are the only advanced economies where this is the case. The housing market in Australia also remains strong, with housing finance commitments continuing to boom in April, driven by existing owner occupiers and investors.

As was the case for international equity markets, the domestic share market was also impacted by comments from Fed members during the month regarding the timing of future interest rate increases in the US (see above).

Domestic and International Fixed Income

Australian government bond yields and US Treasury yields both drifted modestly lower in June, despite early indications that some central banks may start tapering sooner than expected given the recent strength in economic data. In mid-June, the Fed brought forward its timeline of expected interest rate hikes, causing a sell-off in equities markets. However, bond yields were largely stable, having already increased sharply earlier in the year in response to higher inflation expectations.

Australian Dollar

The Australian dollar fell by around 3% against the US dollar in June, to its lowest level since December last year, amid broad US dollar strength. The US dollar rose against most currencies after the Fed brought forward its timeline of expected interest rate hikes at its monetary policy meeting in mid-June.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.