Market Review – December 2023

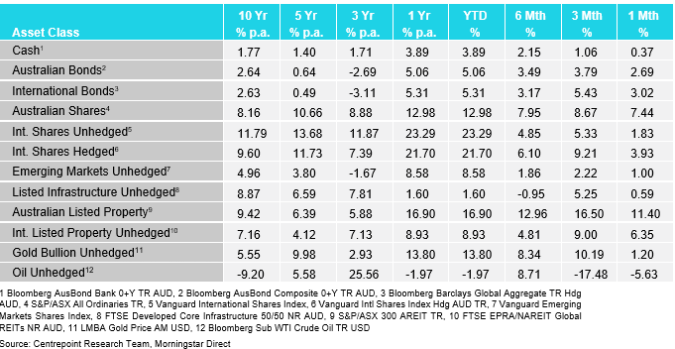

How the different asset classes have fared:

(As at 31 December 2023)

Key Themes

- Fed signalled an additional cut in 2024 which sent yields lower and equity markets higher.

- Strength for Australian Equities and AUD following a more dovish tone at their latest meeting.

- Oil fell on the back of supply/demand issues creating a headwind for energy stocks.

International Equities

Following impressive performance in November, international equities continued to benefit from an increasingly positive outlook in the fed’s battle with inflation. In December the US Federal Reserve (Fed) indicated an additional rate cut in 2024 bringing the total projection of cuts in 2024 to 75bps (basis points). This resulted in gains of 1.83% for the unhedged share class and a notably higher monthly return of 3.93% for the hedged class, reflecting a weaker US dollar following the Feds latest comments.

Rate sensitive parts of the market outperformed in December, in particular small caps. The typical structure of small caps mean they rely on short term, and often floating rate debt, making them sensitive to interest rate movements. As a result, further clarity from the Fed regarding 2024 rate cuts caused the global markets to rally. Real estate also posted healthy returns with international property posting a 6.35% return for the month.

Energy was the worst performing sector in December, largely due to falling oil prices providing a headwind to revenue. Despite this, the sector still managed to remain in positive territory for the month highlighting the strength of the international equity market in the final month of the year.

Australian Equities

Australian equities surged in December growing by 7.44% off the back of a more dovish tone coming from the Reserve Bank of Australia (RBA) in December. All sectors rose with real estate, healthcare and materials leading the way gaining 11.4%, 9.1% and 7.4% respectively. These impressive monthly returns can be attributed to a shift in sentiment that rates in Australia have now peaked.

The defensive nature of both utilities and consumer staples meant these areas underperformed in a risk-on month, however both still finished positive. Energy equities also lagged in the month of December as middle eastern tensions were unable to keep oil elevated, overshadowed by subdued demand issues and high levels of supply which caused oil to drift lower.

Domestic and International Fixed Income

With central banks seeming to regain control of inflation in many leading economies, there has been numerous revisions for 2024 rate cuts which has supported fixed income returns in the final month of the year. As a result, international bonds returned 3.02% in the month of December. Notably, US 10-year treasuries fell by 45bps resulting in a 4% gain for the month. Similar performance was seen across the board in developed economies with 10-year yields falling 42bps in Germany, 64bps in Canada and 56bps in New Zealand. Credit markets also rose in December as investors revised the probability of widespread recessions.

In Australia, RBA comments in December led investors to conclude that rates have most likely peaked, creating positive market sentiment. As a result, Australian bonds returned a healthy 2.69% for the month and the Australian 10yr yield dropped 45bps, thus also posting a positive return. Despite the RBA hiking rates in the month prior and data suggesting that Australia is still falling behind peers in the battle against inflation, returns in the Australian fixed income kept up with other developed markets in December.

Australian Dollar

The Australian dollar appreciated in the month of December by 0.37%, notably strengthening against the US dollar for the second month in a row. This was driven by both ongoing weakness in the USD which was further exacerbated in December following the Fed’s latest comments, as well as comparatively higher rates in Australia making the AUD attractive for foreign investors. AUD strengthened against most major currencies in December with the exception being Japan, where there is speculation that the BOJ (Bank of Japan) will soon pivot from its ultra-dovish monetary policy.

Commodities – Gold and Oil

Oil fell in December by 5.63%, making it the only asset class in our update to finish in the red on its own for two consecutive months. Despite both the Israel-Palestine and red-sea conflicts causing volatility in the oil price, the overwhelming supply coming from outside OPEC (notably the US) and subdued demand concerns has sent oil lower in December.

Gold had a stable month, posing a positive return of 1.2%. This was largely due to both the continuation of a weakening US dollar and a further decline in US treasury yields.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.