Market Review – August 2023

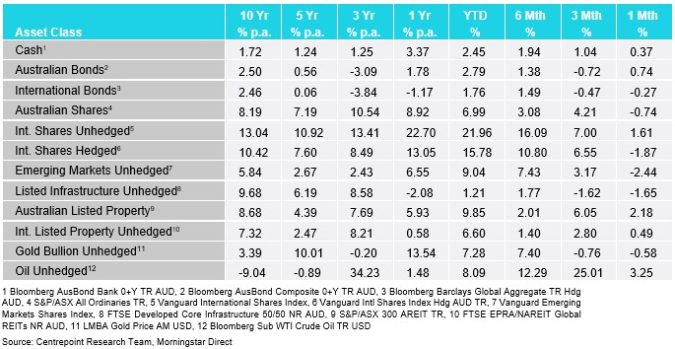

How the different asset classes have fared:

(As at 31 August 2023)

International Equities

The rise in international markets slowed in August with a 1.61% gain in unhedged equities and a 1.87% loss in hedged equities. This divergence is due to a fall in the value of the Australian Dollar relative to USD. With the AI craze slowing slightly the technology sector fell by 2% but this was not the worst performing global sector. Consumer staples, materials, and utilities were the worst performing sectors, losing 2.9%, 3.95%, and 4.6% respectively.

The only sector that didn’t lose ground was global energy which grew by 2%, propelled by an oil price that has continued to rise. The poor performance across the board is not entirely unexpected as August is typically one of the weaker months for equities, the worst historically being September.

China’s stock market specifically has suffered, retreating around 5% over the month, as their real estate situation worsened, and the government stopped releasing their grim youth unemployment statistics, last reported at 21.3%.

Australian Equities

Australian shares retracted by 0.74% over the last month. The first half of August saw Australian equities in a worse position before rebounding slightly after better-than-expected CPI data and strong retail sales for July.

The worst performing sectors were utilities, technology, and materials which reduced by 4.4%, 3.2%, and 3% respectively. The strongest performing sector was real estate with 0.6% growth as the housing shortage continues and inflation data indicates less need for future rate hikes.

Domestic and International Fixed Income

In August, Australian bond prices rose by 0.74%. This can be partially attributed to slowing inflation reducing the chance of further RBA cash rate increases and bringing forward potential reductions. While these may be the ‘peak rates’ we will see this tightening cycle there is still a long way to go for inflation to be under control.

International bonds fell slightly by 0.27% as investors reacted to conflicting signals surrounding the fight against inflation. US jobs and payroll data showed signs of increasing control on inflation, but Fed Chair Jerome Powell remained hawkish during his speech in Jackson Hole, stating that inflation is still too high. The consensus seems to be that we have reached the peak but one more increase is still in the cards.

Australian Dollar

The Australian Dollar (AUD) fell by 3% over the month. This was partly due to the US Dollar index rising just over 2.1%. This decline was also stemming from continuing weakness in China and its worsening real estate market, combined with indicators hinting towards inflation getting under control without further cash rate increases.

Commodities – Gold and Oil

Gold fell by 0.58%, restarting its decline from June after a short rise in July. During the first half of the month gold declined as uncertainty continued around future rate hikes in the US and other countries. Heading into the second half of the month we started to see positive inflation and jobs data that led investors to believe the end of rate hikes was close.

Oil rose by 3.25% this month, much slower than July’s incredible 16.09% increase. This would be the continued effect of the supply cuts from OPEC and increasing confidence in stable demand as interest rate increases begin to seem less likely in the US.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.