Market and Economic Update – June Quarter 2022

UNDERSTANDING THE RECENT MARKET VOLATILITY

Prepared by: Centrepoint Alliance

June Quarter 2022

1. Markets in Review

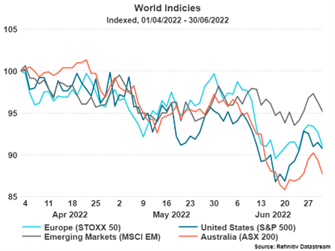

Markets continued to be impacted by inflation and interest rate increases within the second quarter of 2022. Australia, which performed well at the beginning of the year, has been the worst performer on the quarter among the major equity indices. This is primarily due to the significant falls in material and commodity prices that Australia exports. The drops in these prices come as concerns over economic growth begin to surface. Surprisingly, the tightening economic conditions within western countries has meant relative outperformance in Emerging Markets. This is something that has not occurred for some time as regulatory pressures in China and the recent lockdowns have significantly impacted their economy.

Australia markets fell 12.4% during the quarter, United States fell 9.3% and Europe dropped 9%. Emerging Markets was the least impacted only falling 4.9%.

1.1 Australian Sector Returns

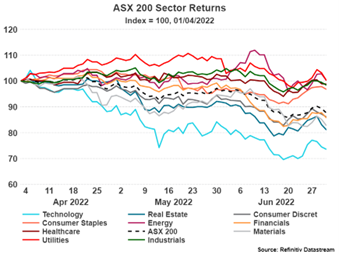

Interest rates continue to put pressure on the sectors most senstive to their increases. Technology fell a significant ~28% on a quarter as the worst performing sector. This was followed by Real Estate with a ~19% fall. Materials, which are not directly impacted by interest rates but are affected by a slowing of economic activity primarily stemming from the weakness in China, fell ~18%.

The only positive sectors on the quarter were utilities and energy but only by 0.2% each. A combination of interest rates, inflation, and slowing economic sentiment has pulled the market down as a whole significantly. No sector was safe during the last 3 months as Australia finally joins the rest of the global markets with significant negative performance. It is expected that the more defensive sectors such as utilities, consumer staples, and healthcare will be the better performing sectors over a slowing economic period.

2. Foreign Exchange Markets

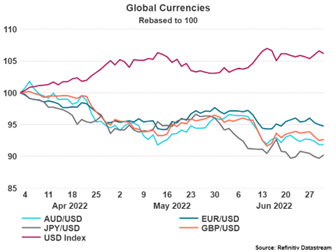

This has a been a story of United States Dollar (USD) dominance across the quarter. All currencies were significantly down on the quarter versus the USD as the safe haven perception of the currency has taken priority in the mind of investors. This is also combined with the fact the Federal Reserve Bank of the United States has raised rates at a faster pace than other central banks around the world as they attempt to stem the rapid inflation apparent within the economy. This has made the USD more attractive as investors can now gain higher interest on cash when holding money in US Dollars.

The Japanese Yen fell the most on the quarter with a near 10% decrease in the currencies value. The Euro fell the least with still a significant 5% drop. The Euro for the first time in 20 years has fallen to a 1:1 parity with the US Dollar, further emphasising it’s strength.

The Australian Dollar continues it’s downtrend with an 8.2% drop. This is less a comment on weakness within the Australian economy, but rather strength within the US currency.

A surprising drop in the Japanese Yen, a currency generally seen as a safe haven currency, took place across the quarter as investors rotated money out of Yen into the US Dollar to take advantage of the higher interest rates that have been priced into the US market. The Bank of Japan have not indicated significant increases in interest rates, leaving the currency more exposed to inflationary pressures.

3. Fixed Income Markets

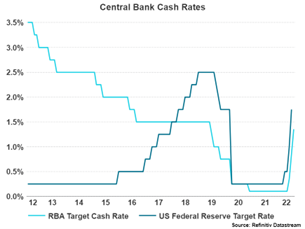

Central banks have made it their explicit priority to contain inflation. This means a fast adjustment higher in interest rates set by Central Banks is the policy response. The pace of this adjustment higher is highlighted by the below chart. These rates are expected to increase further and potentially at a faster pace as markets begin to bet on a 1% increase at the next Federal Reserve meeting due to the reacceleration in inflation within the July number.

The pace of these increases has caused significant selloffs in fixed income as interest rates have increased across the quarter. Significant interest rate increases have mostly been priced into these markets.

Whilst short-term rates continue to rise, there has been some stability and even decreases in long term rates. This signals that central banks will not be able to raise rates indefinitely as the increasingly tightening financial conditions will force an eventual reversal in this policy.

4. Outlook

Research’s outlook on the current environment has moved more negative as inflation becomes a bigger issue that central banks have explicitly outlined needs to be addressed.

Within equities, interest rate increases have put pressure on the ‘growthy’ technology parts of the market. These stocks have already been heavily impacted across the entirety of this year so far. Whilst some of these areas may be starting to look attractive, interest rates will continue to halt speculative investing in the short to medium term. If inflation begins to moderate and decrease and therefore pressure lessens on central banks to continue to increase rates, then this part of the market will react positively. The ‘value’ stocks have performed very well over the past year and a safe haven to the ‘growth’ stock downside. This has halted in the past month as a recessionary environment looms on global economies. Remember, ‘value’ stocks are more economically sensitive and will be impacted heavily as economic activity decreases. This ultimately means that there may be no safe places to hide within equities over the coming months. Research have increased exposure to low volatility managers that put strong emphasis on downside protection when markets are falling. This is recommended to help stem the losses in the equity components of the portfolio.

Within fixed income, a lot of the losses and the future interest rate increases have already been priced in. If inflation continue to increase, there may be further losses, however if a slowdown in economic activity continues to play out, it is likely this begins to moderate over the medium term. This means that it is important to maintain exposure to these investments as a recessionary environment would allow fixed income to finally begin to play defence for your portfolio. This hasn’t been the case so far as interest rates have increased along with inflation. Make sure to not panic in this environment and have faith that the fixed income part of the portfolio will begin to show signs of positive improvement.

Remember, if inflation moderates and an economic slowdown begins to show up in the economic data, all central banks have to do is state that interest rates will not be raised as much as they have been and even look to cease the rate rises all together. If they did this, bonds will rally along with stocks as less pressure from interest rates is extremely positive for both bonds and equities. This may take time to play out, but now is not the time to sell down a portfolio, especially the fixed income side of the portfolio. Instead using instruments like Term Deposits and short-duration income fund managers may help decrease the volatility.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.