Market Review – April 2021

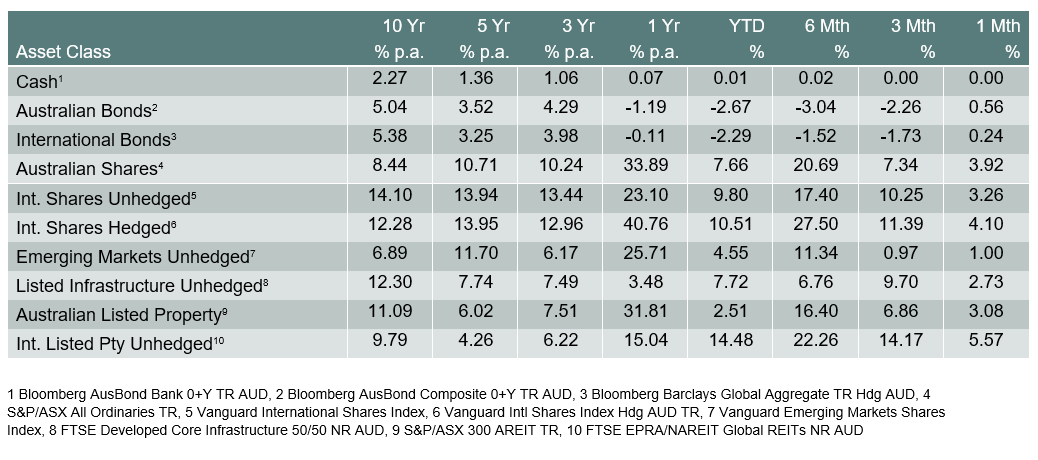

How the different asset classes have fared:

(As at 30 April 2021)

Australian Equities

April was a great month for the Australian Share market with the S&P/ASX All Ord rising 3.92% over the period. Traditionally the month is a strong month for the share market as the end of financial year approaches. A great deal of the positive momentum can also be attributed to low interest rates, market stimulus and a rebound of economic activity. Materials was the best performing sector, driven largely by stronger metal prices and a slightly weaker US dollar. Technology also did well, due to by a decline in Australian bond yields. Energy was the worst performer with coal being a notable area of weakness within energy, as investor sentiment towards the carbon emitting sector sours.

International Equities

The global recovery is continuing to gather momentum with the IMF revising up its 2021 global growth forecast to 6.0%. The recovery has been positive for share markets which benefit from rising earnings and low interest rates. US stocks did well buoyed by multiple signs of economic recovery; including an impressive jobs report, a jump in retail sales, and a pick-up in housing. European markets also moved higher, lifted by solid corporate earnings and the progress made by EU countries in vaccine distribution. A recent surge in Covid cases plaguing India and Brazil has put pressure on these emerging economies and their markets. Overall, the performance of emerging market equities was flat. The slow vaccine rollout in the developing word is holding back emerging market stocks.

Domestic and International Fixed Income

Global and domestic bond yields eased back in April as central banks reiterated their desire to keep accommodative financial conditions. The recent stability in bond yields enabled share markets to resume their rising trend after a few wobbles earlier in the year.

Australian dollar

The Australian dollar continued to maintain its strength in April. Strong commodity export prices have helped keep the dollar strong.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.