Federal Budget 2020: Economic recovery plan for Australia

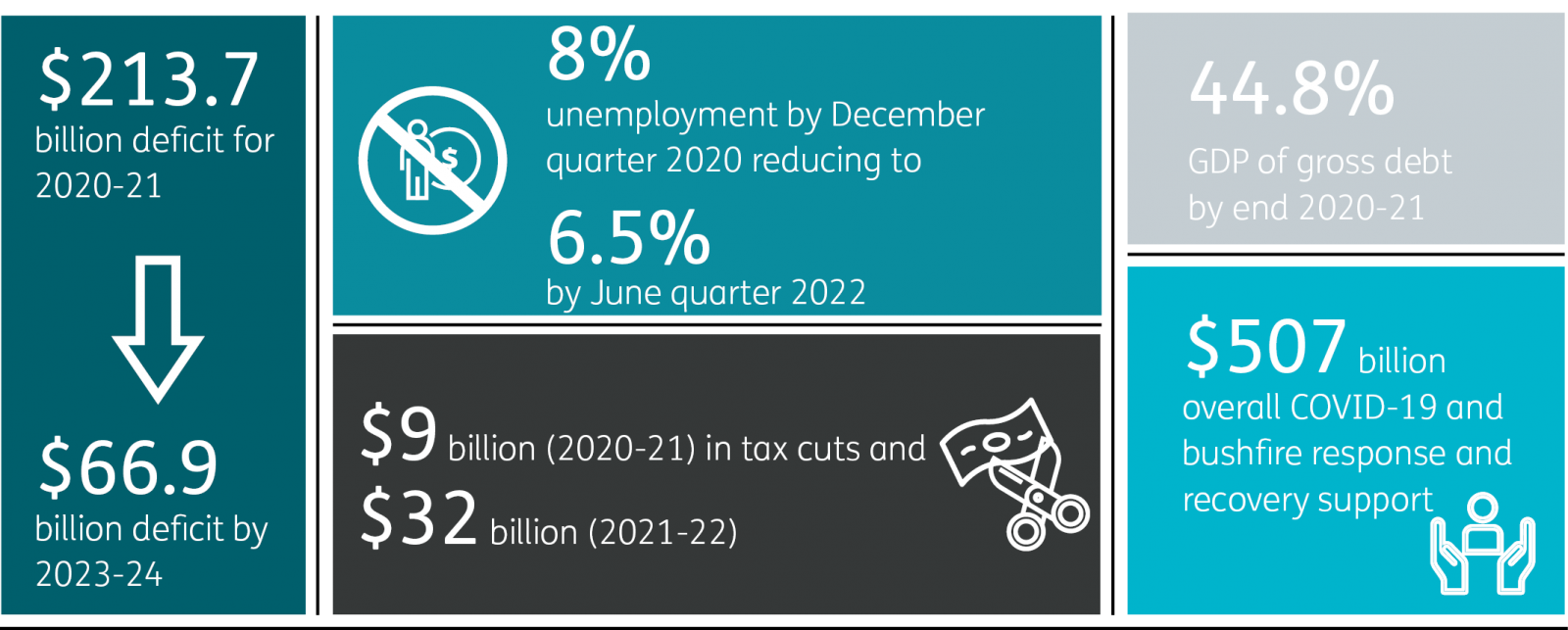

As predicted, spending to stimulate the Australian economy was the focus of this year’s Federal Budget. The JobMaker Plan is the Government’s $74 billion response to support a stronger economic recovery and bring more Australians back to work. Tax cuts for individuals and business is also a major element of the recovery plan.

Below we provide a ‘quick look’ at the announcements relating to superannuation, tax, small business, social security and job incentives. Please remember the measures outlined below are proposals only and are subject to change until legislated.

Tax

- Stage 2 of the Government’s Personal Income Tax Plan will be brought forward by two years from 1 July 2022 to 1 July 2020 meaning:

- The top threshold of the 19% bracket will increase from $37,000 to $45,000.

- The low income tax offset (LITO) will increase from $445 to $700 with more favourable reduction rates.

- The top threshold of the 32.5% bracket will increase from $90,000 to $120,000.

- The low and middle income tax offset will be retained for the 2020-21 year providing a reduction in tax of up to $1,080.

- Whilst practically the measures are backdated to 1 July 2020, the effect will be that PAYG tax for the remainder of the financial year will be reduced to account for tax already paid.

Business Stimulus

- Businesses with annual turnover less than $5 billion will be able to deduct the full cost of eligible capital assets acquired from 6 October 2020.

- For small and medium sized businesses (annual turnover < $50 million), full expensing will also apply to second-hand assets.

- Businesses that hold assets eligible for the enhanced $150,000 instant asset write-off will have an extra six months to first use or install those assets.

- Eligible companies (with aggregated turnover of less than $5 billion) will be allowed to carry back tax losses from the 2019-20, 2020-21 or 2021-22 income years. This may generate a refundable tax offset in the year the loss is made whereas usually tax losses can only be applied against future earnings.

Social Security and Aged Care

- Two additional $250 lump sum payments will be available to eligible social security, veteran and other income support recipients and eligible concession card holders with the first payment available in November 2020 and the second in March 2021.

- The payments will be received tax free and will not impact existing income support payments.

- An additional 23,000 home care packages across all package levels will be made available over the next four years.

Superannuation

- Notably there was no mention of:

- a third round of COVID-19 early release payments

- delaying the already legislated increase to Super Guarantee Contributions

- extending the 50% temporary reduction in minimum payments for retirement income streams beyond 2020-21.

- The Government will provide $159.6 million over four years to implement reforms to superannuation to improve outcomes for superannuation fund members.

Miscellaneous Measures

- JobMaker Hiring Credit will be available from 7 October 2020 for each additional new job created for an eligible employee. Employers will receive $200 per week if they hire an eligible employee aged 16 to 29 years or $100 per week for those aged 30 to 35 years.

- The First Home Loan Deposit Scheme will be expanded to help an extra 10,000 people with property value thresholds for eligibility also increasing.

- The Government is investing an additional $1.2 billion through the Boosting Apprenticeships Wage Subsidy to support up to 100,000 new apprentices and trainees as well as delivering 50,000 higher education short courses.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.